Jim Paulsen with Wells Fargo is the ultimate optimist who anticipates 3% economic growth this year and a definite turn around in 2012.

Click Here

Showing posts with label economy. Show all posts

Showing posts with label economy. Show all posts

Monday, March 26, 2012

Resurrection of confidence in economy - but will it last?

Labels:

2012,

commercial,

Commercial Real Estate,

economic growth,

economy,

Jim Paulsen,

money,

mortgage,

multifamily property,

Wells Fargo

Wednesday, October 19, 2011

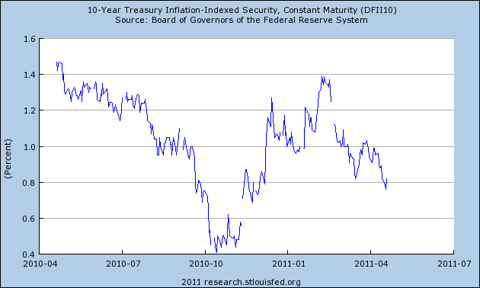

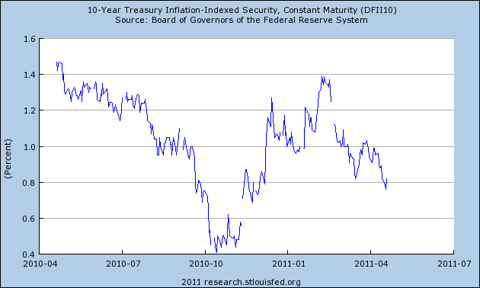

Are You Ready for Inflation?

Thursday, June 23, 2011

Meltdown?

This article really covers what the likely scenarios are for the World Economy and more specifically the US Economy. From a Real Estate perspective this definitely presents an opportunity for future acquisitions. With tighter lending standards, the “restructuring” of Fannie and Freddie in essence meaning phasing out, and flattening of the economy, there will be new buying conditions that will present lower price points but also a need to dig deeper for funding.

Read More

Read More

Wednesday, June 15, 2011

Double Dip?

1. Supply-chain disruptions caused by the earthquake and tsunami in Japan

2. Severe weather and flooding in the Southeast and Midwest

3. The recent ease of high gasoline prices

Read more

Monday, June 13, 2011

Stuck in Neutral?

An interesting piece by David R. Pascale, Jr. He states flat economic reports has markets in a static state and that no new significant policies are being considered. Furthermore the treasury yields have settled in at 2011 lows. He also refers to another recent column where the "new normal" may mean flat growth and high unemployment.

Read more

Read more

Wednesday, May 4, 2011

Mobile Home Parks: A Stable Investment?

Warren Buffet is known for loving all things low in cost but high in value, and mobile home parks seem to fit the criteria. Buffet is the largest owner of mobile home manufacturing and financing in the United States, and there is a reason why. He sees the lower end of the market as a stable investment.

Read more

Read more

Labels:

economy,

investing,

investment,

investors,

Market Trends

Monday, May 2, 2011

U.S. Economy Holding Strong?

An interesting opinion into the strength of the U.S. economy. It doesn’t paint a very bright picture.

Read More

Read More

“Luxury Tax” Hopes to Cool Property Market

Taiwan wants to pass a luxury tax in order to try and curtail wide spread property speculation and the worst wealth gap in a decade. The Taiwanese people support the move while real estate agents and the property sector do not. What do you think? You be the judge.

Read More

Read More

Labels:

asia,

economy,

market,

property,

real estate,

Real Estate Political Issues,

tax

China to designate RMB clearing bank in Singapore

The People's Bank of China is looking to Singapore to internationalize the Renminbi with the goal of facilitating trade between China and southeast Asian countries.

Read More

Read More

Ten Things of Know When Starting A Fund?

All of us in this business want to be principals. Now is the time to buy, but how do you raise the dough? Learn more.

Trophy Investors Snag 9900 Wilshire for $148 million

The International players are back. This high profile property in Beverly Hills originally purchased by a British group in '07 for $500 million just sold for $148 million with a Singapore Buyer... read full article.

Labels:

economy,

high profile,

international,

investors,

Market Trends,

property

2010 CMBS Modifications Outnumber the Last 2 Years Combined

Sign of further loan modifications for sellers and possibly buyers. http://bit.ly/cfxg4X

Labels:

buyers,

economy,

loan,

Market Trends,

sellers

Recession Lessons

Great article about how five brokers have adapted their practice to survive the downturn. Read More

GDP at 5.7%

The U.S. economy surged at the end of 2009, driven more by slower inventory liquidation than by consumer spending. Gross domestic product rose at a seasonally adjusted 5.7% annual rate from October through December, the Commerce Department said Friday in its first estimate of fourth-quarter GDP.

GDP has gone up two straight quarters, rising 2.2% in the third quarter after a year of contraction. In all of 2009, GDP fell 2.4%, the biggest drop for an entire year since 10.9% in 1946.

Read More

GDP has gone up two straight quarters, rising 2.2% in the third quarter after a year of contraction. In all of 2009, GDP fell 2.4%, the biggest drop for an entire year since 10.9% in 1946.

Read More

Labels:

consumer,

economy,

GDP,

liquidation,

Macroeconomics,

spending

Subscribe to:

Posts (Atom)